“`html

Smart Ways to Become a Bookkeeper in 2025

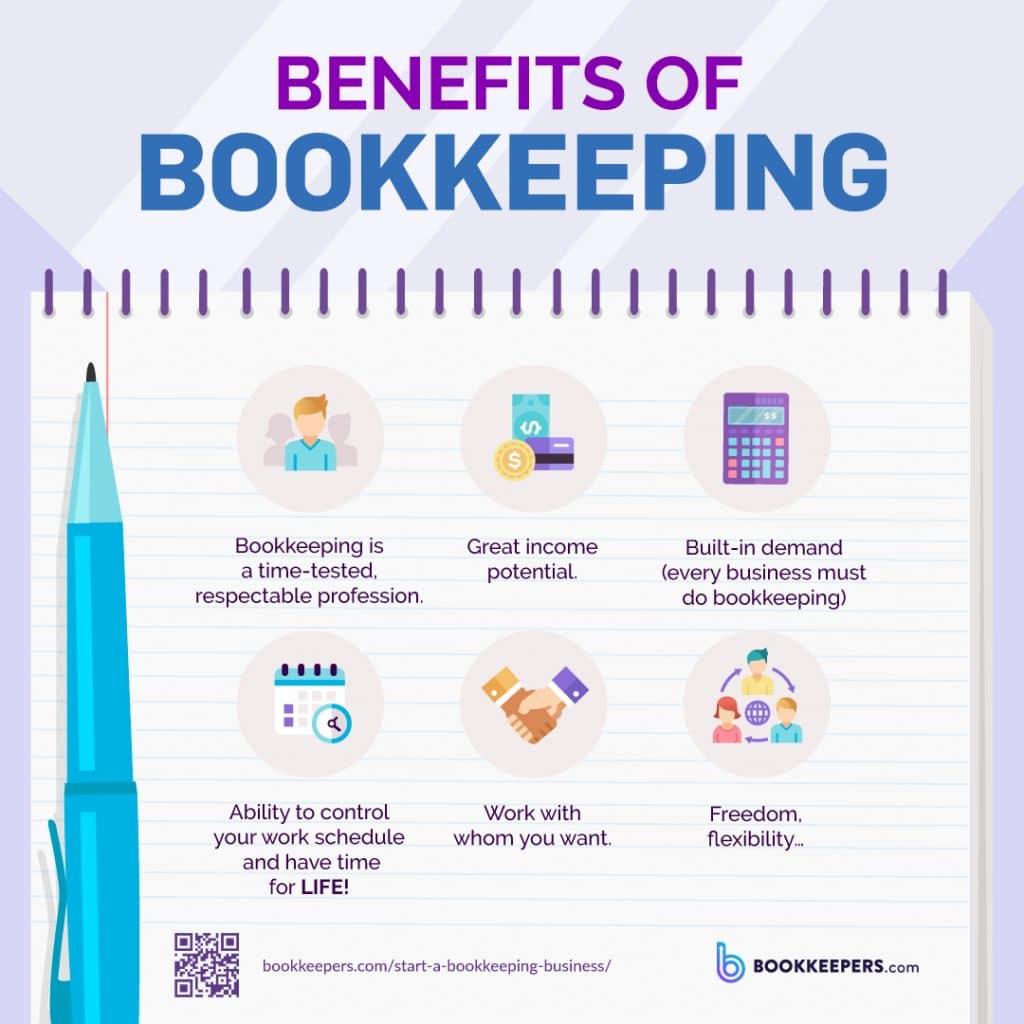

As industries and businesses continue to evolve, the demand for skilled individuals in accounting and finance grows, making a career in bookkeeping more viable than ever. If you’re passionate about numbers and organizational tasks, learning how to become a bookkeeper can open numerous doors. This article will explore essential bookkeeping skills, necessary training and certification paths, and practical tips to help you dive into this rewarding profession.

Essential Bookkeeping Skills for Success

Understanding the fundamental bookkeeping principles is vital for anyone aiming to be a successful bookkeeper. Key skills include a strong grasp of accounting basics, proficiency in bookkeeping software, and the ability to generate and interpret financial statements. Additionally, building capabilities in ledger management and double-entry accounting ensures accurate and reliable financial records.

Understanding Financial Statements

Financial statements provide crucial insights into a business’s financial health. New bookkeepers should familiarize themselves with documents such as balance sheets and profit and loss statements. These reports summarize the assets, liabilities, income, and expenses of a business, essential for any financial analysis. Knowing how to create and interpret these statements is critical for effective small business bookkeeping.

Proficiency in Bookkeeping Software

In today’s digital world, being proficient in the recommended bookkeeping tools and software is non-negotiable. Programs like QuickBooks and Xero streamline the management and reporting of financial transactions. These platforms assist with payroll processing, accounts payable, and accounts receivable management. Additionally, obtaining a QuickBooks certification can enhance employability and showcase your expertise in these vital tools.

Developing Practical Bookkeeping Skills

Engaging in practical exercises and real-world examples enhances learning. Aspiring bookkeepers can simulate scenarios such as bank reconciliation or tax preparation. For instance, taking on a case study where you need to manage business records for a year provides experience in tracking transactions, maintaining documents, and navigating financial regulations.

Pathways for Bookkeeper Training and Certification

Becoming a certified bookkeeper requires following structured bookkeeping courses and training programs. Numerous online options provide flexibility for working professionals. Some of the most recognized certifications include the Certified Bookkeeper designation, which validates your skills and knowledge in bookkeeping ethics, practices, and software.

Online Bookkeeping Courses

Enrolling in online bookkeeping courses is an excellent way to start your journey. Many platforms offer comprehensive training covering everything from bookkeeping fundamentals to advanced topics like financial audits and bookkeeping consulting. You can learn at your own pace, making it ideal for those juggling other commitments. Look for courses that offer practical exercises, case studies, and support from instructors.

Certification vs. Degree

While a traditional bookkeeping degree in finance or accounting can be beneficial, obtaining relevant certifications might offer a quicker pathway to employment. Certifications can often be completed in a shorter time frame compared to a degree. For professionals looking to stand out, pursuing specialized bookkeeping certifications can prove advantageous and is often preferred by employers looking for knowledgeable candidates.

Existing Skills and Career Transition

For professionals seeking to transition into bookkeeping, leveraging existing skills from previous occupations can smooth the learning curve. Skills such as organization, time-management, and financial analysis demonstrate a competencies overlap that may ease the transition. Moreover, exploring freelance bookkeeping opportunities could provide on-the-job experience while earning an income.

Networking and Leveraging Resources

Building a solid network is invaluable within the bookkeeping community. Participate in local and online forums, join professional associations, and engage on social media platforms to meet industry leaders and peers. Doing so can lead to mentorship opportunities and potential job offers, essential for those just starting a career in bookkeeping.

Joining Professional Associations

Becoming a member of professional associations can significantly impact your career. Organizations like the American Institute of Professional Bookkeepers or the National Association of Certified Public Bookkeepers offer resources, networking opportunities, and updates on bookkeeping industry trends. Engaging with professionals in these networks can lead to insights on best practices and help you stay informed about changes in regulations.

Staying Informed About Industry Trends

The bookkeeping industry is continuously evolving due to changes in technology, regulations, and practices. Keeping abreast of industry news through blogs, podcasts, and newsletters informs you about new tools and efficient methods to enhance your skills. Consider attending bookkeeping workshops or webinars regularly for hands-on learning and practical insights into recent developments.

Networking Tips for Bookkeepers

Utilizing platforms like LinkedIn to connect with other bookkeepers and professionals can significantly boost your presence in the field. Additionally, engaging in discussions, sharing knowledge, and showcasing your skills can help you build credibility and trust within the community. Networking can lead to insights, job opportunities, and potential partnerships in freelance work.

Key Takeaways

- Focus on mastering essential bookkeeping skills including financial statement analysis and bookkeeping software proficiency.

- Consider pursuing online courses and certifications to enhance your knowledge and qualifications.

- Utilize networking opportunities through professional associations to stay current on bookkeeping industry trends.

- Adapt existing skill sets from other industries to create a competitive edge in the bookkeeping field.

- Engage with the bookkeeping community to learn from peers and share tips.

FAQ

1. What certifications should I pursue to become a bookkeeper?

It’s advisable to pursue a Certified Bookkeeper designation if you’re serious about your bookkeeping career. This certification demonstrates your understanding of essential bookkeeping principles and adds to your value in the job market. Additionally, QuickBooks certification can be beneficial for those training in specific software.

2. Can I work as a bookkeeper without a degree?

Yes, many bookkeepers succeed without formal degrees, as industry certifications often hold more weight for employers. Focusing on building relevant bookkeeping skills through online courses, internships, or apprenticeships can also be viable paths to enter the field successfully.

3. What are the main responsibilities of a bookkeeper?

Bookkeepers are responsible for managing financial transactions, maintaining accurate records, processing payroll, managing accounts payable and receivable, and preparing financial statements. Organizations depend on bookkeepers to ensure that their financial data is accurate and compliant with regulations.

4. How do I find remote bookkeeping opportunities?

To find remote bookkeeping jobs, online job boards like FreeUp or LinkedIn can provide postings for freelance and remote positions. Networking with other professionals and joining online bookkeeping communities can also uncover hidden opportunities in the market.

5. What are common bookkeeping mistakes to avoid?

Avoid common errors like failing to back up data, mixing personal and business finances, and neglecting tax deadlines. Setting internal controls and maintaining accurate financial records are crucial to ensuring effective bookkeeping operations and minimizing errors.

6. How can I improve my bookkeeping productivity?

To boost productivity, emphasize time management and utilize bookkeeping software to streamline processes. Implementing templates for invoices, and financial reports can also save time and reduce errors in your bookkeeping tasks. Additionally, regularly reviewing and updating your organizational systems can increase efficiency.

7. Why should I consider freelance bookkeeping?

Freelance bookkeeping offers flexibility in setting your hours and choosing your clients. It also allows you to diversify your workload, which can lead to increased income opportunities. Many businesses appreciate remote services, providing ample chances for freelancers in the bookkeeping sector.

“`