How to Properly Read a W2 Form for Modern Tax Filing in 2025

The W2 form is a critical document for all employees when it comes to preparing for tax season. Understanding how to read a W2 form accurately can not only simplify the tax filing process but also ensure that you take full advantage of potential refunds. Whether you are a new employee or a seasoned freelancer, knowing the ins and outs of this form is essential for effective tax planning. In this article, we will provide a thorough explanation of the W2 form, its components, and tips for ensuring accuracy in your tax filings.

Understanding the W2 Form

The W2 form, officially known as the “Wage and Tax Statement,” is an annual summary of an employee’s wages and taxes withheld during the year. This document is essential for accurately filing your federal and state income tax returns. Each W2 form section provides specific information that can impact the amount of tax you owe or the refund you might receive. **Understanding W2** components can help you determine your tax obligations and claims accurately.

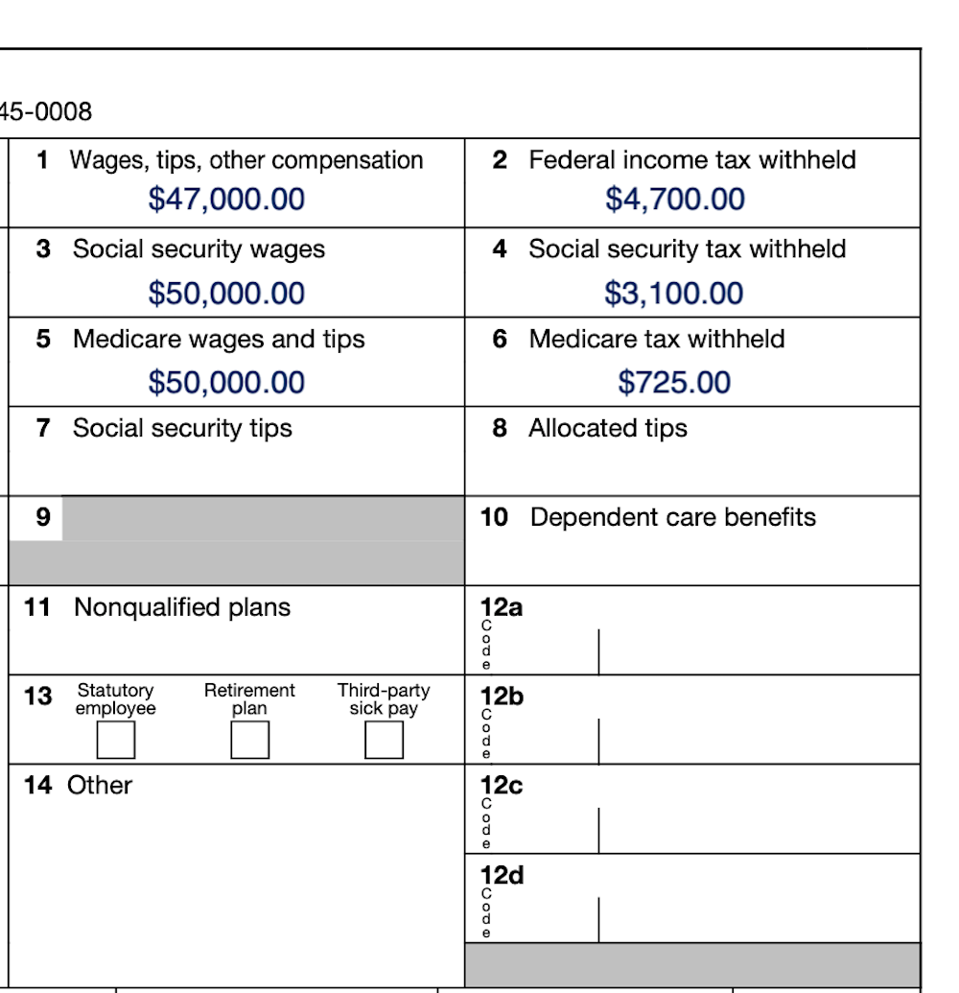

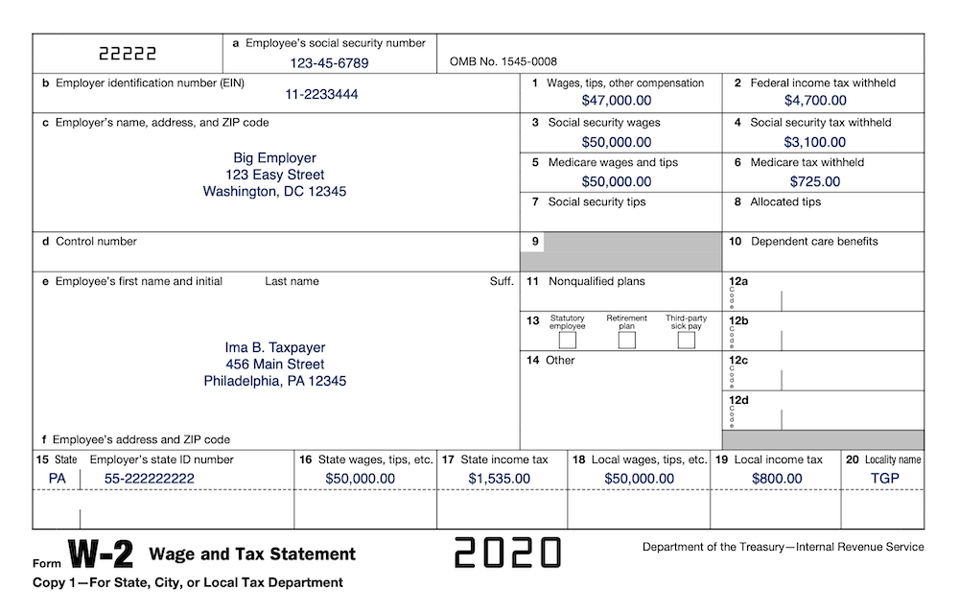

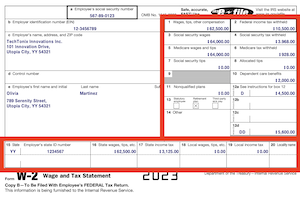

W2 Sections: A Detailed Breakdown

Each W2 form consists of various sections, each containing critical tax information. These sections typically include:

- Employee’s Information: This includes your name, social security number, and address.

- Employer’s Information: Details about the employer, including their name, address, and Employer Identification Number (EIN).

- Wages, Tips, and Other Compensation: This section outlines your total earnings throughout the year, referred to as **W2 income**.

- Federal Income Tax Withheld: The total amount of federal tax deducted from your pay.

- State Income Tax Withheld: Tax amounts withheld at the state level, which vary according to state laws.

Each section of the W2 form serves a purpose, and knowing the **W2 box meanings** can prevent errors during tax filing. Failure to pay attention to these details may lead to inaccuracies in your tax return.

W2 Form Tips for Employees

Reading and interpreting your W2 accurately is paramount for a stress-free tax filing experience. Here are some practical **W2 tips for employees**:

- Always verify the details on your W2 form against your personal records. Ensure your name, Social Security Number, and overall details match your employment records.

- Keep your W2 document in a secure location. Protecting it from loss or damage is crucial, as you will need it for tax preparation.

- Consider accessing your W2 electronically through your employer’s HR portal. This may provide you with additional **W2 online resources** for understanding your tax situation.

Interpreting Your W2 for Maximum Accuracy

To effectively fill out your tax returns, you need a firm grasp of how to extract relevant information from your W2 form. **Interpreting W2** details correctly ensures that taxpayers report their incomes and file deductions correctly, potentially affecting their tax returns favorably.

Deciphering W2 Codes and Abbreviations

The W2 form often contains abbreviations and codes that may seem daunting at first. Common codes include:

- Box 1: Wages, tips, and other compensation.

- Box 2: Federal income tax withheld.

- Box 12: Various codes indicating retirement plan contributions, health insurance deductions, etc.

Understanding these codes is essential for a seamless tax experience. If you encounter any unclear information, consider reaching out to your employer or using educational resources for deeper understanding.

Common W2 Mistakes and Troubleshooting

Mistakes can happen, leading to complications when filing your taxes. Here are some frequent errors to watch for, as well as tips on how to resolve them:

- Incorrect Social Security Number: Ensure that your SSN matches your personal information to avoid processing delays.

- Missing Income: Always double-check that the figures listed match your pay stubs.

- Late W2 Submission: Be aware of W2 deadlines to ensure timely receipt of your form, avoiding last-minute rushes during **W2 filing**.

Correcting these mistakes early can help you avoid issues with the IRS or delays in processing your tax return.

W2 Filing Process and Annual Summary

Filing taxes using your W2 involves several steps, each contributing to an organized process that simplifies tax preparation. Understanding the **W2 filing process** can make the experience less overwhelming.

Step-by-Step Guide to Filling Out Your Tax Return with W2

Here is a streamlined guide on filling out your taxes using your W2:

- Gather all pertinent documents, including your **W2 form details**.

- Use tax software or forms provided by the IRS to start filling out your tax return.

- Enter your W2 details exactly as they appear in Box 1 (wages), Box 2 (tax withheld), and other crucial sections.

- Review your entries for accuracy before submission. Consider seeking assistance if necessary to ensure that everything aligns correctly.

Utilizing this step-by-step method ensures a more pleasant filing experience, allowing you to maximize potential refunds or minimize owed taxes.

Exploring Tax Implications and Benefits

Your W2 plays a significant role in determining your overall tax liability. An **understanding of W2 tax implications** can reveal potential benefits or deductions. Taxpayers should remain aware of any tax exemptions that could apply, as they can also reduce the tax amount due. Take the time to explore all available benefits related to your W2, ensuring that you are not overlooking any possible savings you might be entitled to.

Key Takeaways

- Accurate interpretation of your W2 form is essential for successful tax filing.

- Pay attention to every section and understand what information it contains.

- Correct any errors promptly to avoid complications with the IRS.

- Utilize available resources or seek expert help for complex tax situations.

- Be aware of critical deadlines related to your W2 submission to streamline the filing process.

FAQ

1. What if I misplaced my W2 form?

If you’ve lost your W2 form, the first step is to contact your employer. They are required to provide another copy. You can also access electronic copies if your employer uses an online payroll system.

2. Can I file my taxes without a W2?

While you may file without a W2, it is strongly discouraged as this form provides critical income data necessary for accurate submissions. If you cannot obtain your W2, the IRS suggests using pay stubs to estimate your income, but obtaining an accurate W2 is preferred.

3. Are there different rules for freelancers regarding W2 forms?

Freelancers typically receive a 1099 form instead of a W2. The W2 form is specifically for employees. If you are a freelancer, understanding the implications of the 1099 is crucial as it relates to self-employment tax obligations.

4. How does my W2 affect my tax refund?

Your W2 indicates your total earnings and the tax withheld, which plays a crucial role in determining any refund you may be eligible for. The lower your withheld income tax, the higher the likelihood of owing payment when you file.

5. Can I correct errors on my W2 after I’ve filed my tax return?

If you discover errors after filing, you must correct them by filing an amended tax return using Form 1040-X. Ensure that your W2 reflects the accurate information to avoid trouble with the IRS in the future.

6. What are the deadlines for receiving my W2?

Employers are required to provide W2 forms to their employees by January 31st of each year. If you have not received your W2 by mid-February, follow up with your employer.

7. How do state wage amounts on my W2 impact my tax return?

State wages listed on your W2 are used to calculate your state income tax deductions. If you live in a state with an income tax, it’s essential to account for this information when preparing your tax return to avoid underreporting your income.