Effective Ways to Calculate Operating Income in 2025: A Comprehensive Guide

Understanding operating income calculation is crucial for any business striving for financial health and sustainability. This guide will demystify the various elements of **operating income**, shedding light on its significance, its formula, and how to analyze it effectively in today’s business environment. By the end of this article, you will have a robust understanding of **how to calculate operating income**, along with useful tips and examples to apply in your own financial analysis.

Understanding Operating Income

The definition of **operating income** refers to the profit a company makes from its core business operations, excluding expenses associated with non-operational activities such as investments or sales of assets. The importance of operating income lies in its ability to give stakeholders a clear view of a business’s profitability and efficiency in its primary operations. In addition, **operating income** serves as an indicator of a company’s financial performance that can impact investor relations and overall business growth.

Components of Operating Income

The key components that contribute to **operating income** include **operating revenue** and **operating expenses**. **Operating revenue** consists of the earnings from the sale of goods and services directly related to a company’s core operations. On the other hand, **operating expenses** refer to the costs incurred in conducting the business, including wages, utility bills, and other overhead costs. Understanding these components better aids in determining the exact **operating profit calculation** necessary for maintaining a business’s financial health.

The Operating Income Formula

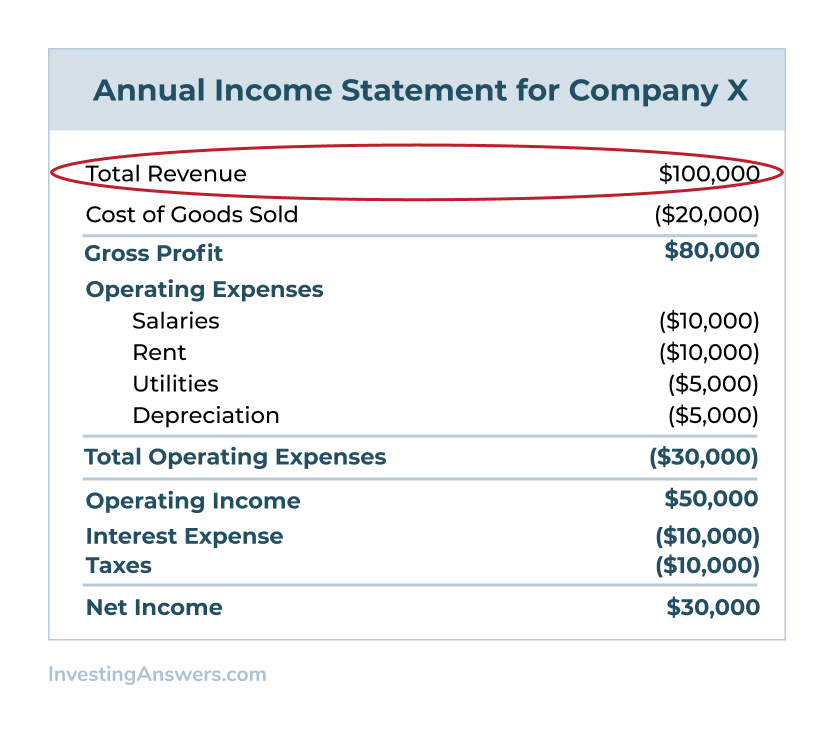

The **operating income formula** can be represented as follows: Operating Income = Operating Revenue – Operating Expenses. This formula allows business owners and financial analysts to quickly assess the profitability of their core operations. A comprehensive **operating income analysis** using this formula can reveal trends, enabling businesses to make informed decisions about cost management and revenue enhancement strategies. Additionally, knowing how to use the **operating income formula** effectively aids in presenting transparent financial reports to stakeholders.

Importance of Accurate Operating Income Reporting

Accurate reporting of **operating income** is crucial as it influences managerial decisions, investor perceptions, and budgeting processes. Well-defined **operating income metrics** enable businesses to objectively evaluate their operational performance over time, leading to timely adjustments that can enhance profitability. Moreover, understanding the significance of precise **operating income** calculations can also provide insights into operational efficiency and areas for improvement, thus potentially contributing to a company’s long-term success.

Calculating Operating Income: Practical Steps

When embarking on the task of calculating operating income, it is vital to approach this with a structured methodology. Knowing effective **methods for calculating operating income** enables businesses to tailor their analysis to specific challenges and financial environments they encounter.

Step-by-Step Guide to Calculate Operating Income

To illustrate how to calculate operating income effectively, follow this structured approach:

- Gather Financial Statements: Collect the latest income statements and balance sheets to obtain relevant data.

- Identify Operating Revenue: Calculate total revenue from primary business activities, excluding non-operating income.

- Document Operating Expenses: List all costs associated with running the business, paying special attention to fixed and variable costs.

- Apply the Operating Income Formula: Utilize the formula Operating Income = Operating Revenue – Operating Expenses to arrive at your figure.

- Analyze Trends Over Time: Conduct an **operating income analysis** by comparing your results with previous periods or industry benchmarks.

This structured approach not only ensures accurate calculations but also helps businesses in **analyzing operating income over time**, allowing for comprehensive insights into their operational effectiveness.

Utilizing Technology in Operating Income Calculation

In today’s digital age, various software tools assist businesses in accurately tracking and calculating **operating income**. Spreadsheets and financial software can greatly enhance the efficiency of these calculations by automating data entry and performing complex analyses quickly. Utilizing technology effectively can minimize errors in calculations and ensure that businesses present precise data to stakeholders, effectively increasing trust and credibility in financial reporting.

Analyzing Operating Income for Strategic Decisions

The role of **operating income in business** strategy cannot be overstated; it offers insights that directly impact decision-making. A well-done **operating income analysis** provides a foundation for making critical business choices regarding pricing strategies and cost management.

Evaluating Operating Income Performance

When **evaluating operating income performance**, businesses must contextualize their results against both historical data and the competitive landscape. A comparative analysis allows businesses to identify their standing in the industry and highlight areas where they may need to adjust strategies. By focusing on trends and variations in **operating income**, companies can identify their strengths and weaknesses, informing strategies aimed at improving overall performance.

Factors Affecting Operating Income

Several internal and external factors can impact **operating income**, including market conditions, economic trends, and even regulatory changes. Understanding these elements can aid businesses in identifying potential risks and devising strategies to mitigate them. For instance, fluctuations in customer demand can lead to changes in **operating revenue**, necessitating swift operational adjustments to maintain profitability. Recognizing these trends early allows companies to strategize accordingly—be it through enhancing sales efforts or tightening expense controls.

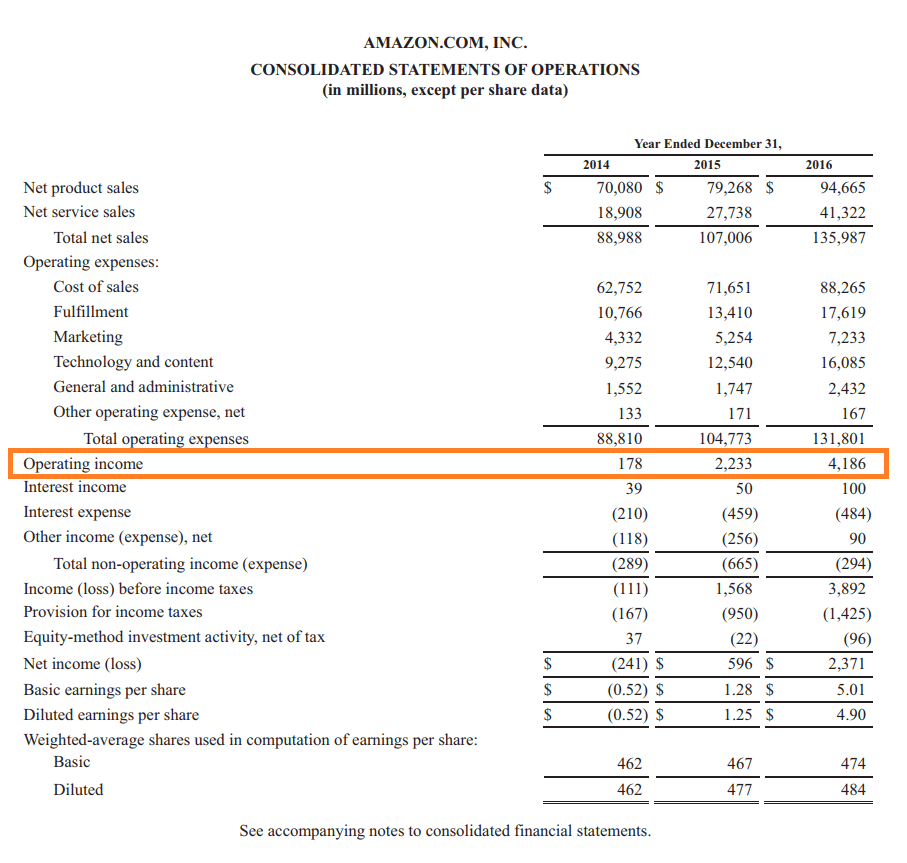

Case Study: Operating Income in Industry Practice

To further illustrate **operating profit calculation**, consider a manufacturing business. By tracking **operating income over several quarters**, it notices that seasonal market demand leads to predictable peaks and valleys in revenue. By analyzing these trends and adjusting production and staffing levels, they successfully enhance **operating income margins**, thus aligning operational capacity with projected demand. Such examples highlight the practical application of proper **operating income analysis** in real-world settings.

Key Takeaways

- Understanding operating income: is essential for gauging a business’s financial health.

- Accurate calculations: facilitate informed decision-making and strategic planning.

- Data analysis: of operating income allows businesses to identify growth opportunities and areas needing cost control.

- Using technology: can streamline the calculation process and offer deeper analytical insights.

FAQ

1. What is the difference between operating income and net income?

The primary difference is that **operating income** focuses on profitability from core business activities, while **net income** considers all revenues and expenses, including non-operating factors like taxes and interest. This distinction is vital for companies analyzing their operational effectiveness without external influence.

2. Why is operating income important for small businesses?

For small businesses, understanding **operating income** is crucial as it helps individual entrepreneurs assess their financial health independently from one-time events or loan interest payments, allowing targeted management of resources and better strategic planning.

3. How can businesses improve their operating income?

Businesses can enhance their **operating income** by optimizing their operations—this may involve reducing overhead costs, improving sales strategies, or expanding product offerings. Accurate analysis of **operating expenses** is fundamental in recognizing where these improvements can most beneficially impact profitability.

4. What tools can assist in the calculation of operating income?

Utilizing accounting software like QuickBooks or Excel templates specifically designed for financial tracking is vital for helping businesses efficiently calculate **operating income** while reducing the likelihood of errors stemming from manual calculations.

5. How do seasonal variations affect operating income?

Seasonal variations can significantly influence **operating income**, affecting sales volumes, inventory levels, and overall operating expenses. By identifying seasonal trends, companies can better manage resources and take proactive measures to maintain steady income throughout varying business cycles.

6. How is operating income reflected in financial statements?

**Operating income** is typically reported on the income statement and provides stakeholders insight into the company’s core operational performance. It’s crucial for understanding financial health separate from irregular gains or losses.

7. What are some common mistakes in operating income calculation?

Common errors in calculating **operating income** include failing to accurately account for all relevant **operating expenses**, leading to inflated profit figures, or neglecting to differentiate between **operating revenue** and non-operational income. Addressing these issues is key to achieving a clear and accurate financial picture.