“`html

Smart Ways to Cash Out on Cash App: Discover the Latest 2025 Fees and Charges

Understanding Cash App Cash Out Fees

The Cash App cash out fees can sometimes be confusing for users. As of 2025, the platform has introduced various fees associated with transactions, primarily highlighting **Instant Cash Out** and standard bank transfers. It’s crucial to familiarize yourself with these specific fees to avoid unexpected charges while cashing out your funds. To ensure you are well-prepared, understanding the different Cash App withdrawal charges can greatly enhance your experience with this mobile payment app.

Breaking Down Cash App Withdrawal Charges

Users often wonder about the Cash App cash withdrawal fee structure. Cash App provides two main options for cashing out: standard transfers, which are typically free but may take 1-3 business days, and **instant transfers**, for which a fee of 1.5% applies. For instance, if you cash out $100 using the instant transfer option, you will incur a fee of $1.50. Being equipped with this knowledge enables you to select the best withdrawal method based on your urgency and financial needs.

The Cash App Cash Out Process Explained

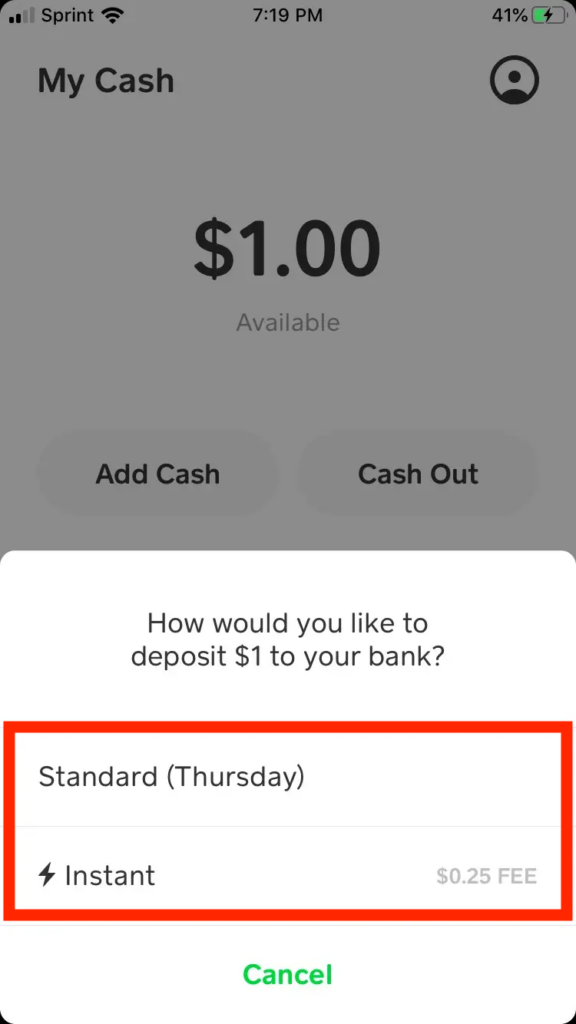

Cashing out on Cash App is straightforward. Users should first tap on their balance on the home screen, then choose **Cash Out**. Following this, input the desired amount you wish to withdraw, select either instant or standard transfer, and confirm the transaction. Understanding the Cash App cash out process is vital, especially if you want to estimate any fees for cashing out Cash App transactions efficiently.

Cash App Cash Out Limits

Currently, Cash App imposes withdrawal limits on various transactions. New users have a limit of $250 for 7 days and a maximum withdrawal of $1,000 within any 30-day period. These Cash App cash out limits help to prevent fraud and ensure security. If you find these limits too restrictive, consider verifying your account to lift such restrictions and access larger withdrawal amounts.

Comparing Cash App Transfer Fees with Other Services

With increasing competition among peer-to-peer payment apps, many users are curious how Cash App transfer charges compare with similar platforms. Organizations such as Venmo and PayPal offer differing fee structures, making it essential to evaluate which service suits your typical withdrawal needs. With Cash App, the choice of withdrawal method strongly impacts the end fee, especially when examining **Cash App to bank transfer fees** against other applications.

Cash App to Bank Transfer Fees

When initiating a transfer from Cash App to a bank account, several factors determine the fees involved. Standard bank transfers do not incur fees, while instant cash out transfers will deduct the stated percentage charge. Comparing these costs with your bank or alternative services can help you decipher the most affordable and accommodating options for your cash management needs.

Cash App Instant Payout Cost

Understanding the Cash App instant payout cost requires familiarity with its percentage structure. Users benefit significantly when they evaluate how arising fees impact their overall funds during emergency situations. For example, accessing funds without delays through instant cash withdrawals may justify the convenience fee, especially in urgent financial scenarios.

Navigating Cash App Withdrawal Options

The **Cash App withdrawal options** available cater to a vast array of transactions, from the traditional bank transfers to cash withdrawals at ATMs. These options come equipped with their unique fee structures, and utilizing the best approach depends significantly on how and when you wish to access your funds. Consider exploring every facet of Cash App withdrawal options to optimize your financial activities.

Using Cash App for ATM Withdrawals

For those pondering how to access cash directly, you can use your Cash App card at ATMs. Nonetheless, keep in mind that the Cash App cash withdrawal fee structure may involve additional charges from the ATM provider. As a proactive user, confirming these details before proceeding ensures you comprehend how much you will be charged when withdrawing cash.

Cash Out from Account to Checking Account

Utilizing **Cash App to checking account charges** allows for seamless transition of funds to your primary banking system. Generally, initiating such transfers does not incur any fees under regular transfer procedures, highlighting the economical aspect of using Cash App. Take time to assess the benefits that come with leveraging Cash App for your financial needs seamlessly.

Key Takeaways

- Understanding the latest **Cash App cash out fees** is essential for minimizing unexpected costs.

- Choosing between standard and instant cash out methods can drastically change the fees incurred.

- Evaluating Cash App against competitors helps to find the best financial management tool.

- Being familiar with **Cash App cash out limits** is crucial for maximizing withdrawal capabilities.

- ATM withdrawals may come with extra charges that users should be cautious of.

FAQ

1. What fees are associated with cashing out on Cash App?

Cashing out on Cash App may incur fees based on the transfer method chosen. Instant transfers are charged **1.5%** of the transaction amount, while standard withdrawals do not incur any fees, typically taking 1-3 business days to complete. Understanding these details can help users plan accordingly and avoid surprises.

2. How long does it take for Cash App to process a cash out?

The processing time for cash out transactions depends on the chosen method. Standard transfers may take **1-3 business days**, while instant transfers occur almost immediately. Users should factor in these times to ensure they access their funds when needed, particularly in urgent situations.

3. Can I change my Cash App withdrawal method?

Yes, users can change their **Cash App withdrawal options** at any time. When initiating a cash out, simply select your preferred method—staying informed on the respective fees and processing times is advisable for optimal monetary management.

4. Are there fees for using Cash App at an ATM?

Yes, if you choose to withdraw cash from an ATM using your Cash App card, you may incur fees imposed by the ATM operator. It’s recommended to check *your specific ATM’s fees* prior to proceeding with your withdrawal for better financial planning.

5. What happens if I exceed my Cash App cash out limits?

If users exceed their established cash out limits on Cash App, they will be unable to complete the transaction until they either wait for the limit to reset or verify their account for higher limits. Users should work to manage their cash flow to avoid reaching these limits unexpectedly.

6. How can I find help for Cash App fees?

If you have questions regarding your fees or need assistance, contacting **Cash App customer service** is the best course of action. They can provide detailed explanations about your transactions, helping resolve any concerns or confusion you may have regarding their fee structures.

7. Is Cash App safe for money transfers?

Cash App has implemented various security measures to protect users during transactions. While it remains generally safe to use, it’s crucial to follow safety tips, like using unique passwords and two-factor authentication, to secure payments and personal information.

“`