“`html

How to Calculate Beta: Effective Methods for 2025 Financial Analysis

Understanding Beta in Finance

In finance, **beta** represents a measure of a stock’s volatility in relation to the overall market. Calculating beta helps investors understand **systematic risk**. Knowing how to calculate beta allows for effective comparisons between individual stocks and the market benchmark. This section will explore the definition of beta, its importance, and provide a clear **beta coefficient formula** for accurate analysis.

What is Beta?

At its core, **beta** is a numerical value that indicates how much a stock’s price might change compared to movement in the overall market. A beta of 1 signifies that the stock moves in tandem with the market, while a beta less than 1 suggests less volatility. Conversely, a beta greater than 1 indicates greater volatility. The significance of **beta** cannot be understated; it is a critical component when performing **risk assessment** using **beta**, guiding investment decisions based on risk tolerance.

Importance of Beta in Investment Analysis

Understanding the **importance of beta** is crucial for investors. Investors apply **beta** to ascertain the expected risk and return profiles of various securities. Recognizing a stock’s **beta value implications** allows for better asset allocation. When combined with historical data, investors can evaluate **beta’s relationship with market returns**, providing a better comprehension of how a stock may perform over time.

Beta Coefficient Formula

The **beta coefficient formula** is derived from the ratio of the covariance of the stock’s returns with the market’s returns to the variance of the market returns. In mathematical terms, it’s represented as:

Beta (β) = Covariance(Returns of Stock, Returns of Market) / Variance(Returns of Market)

This formula provides the foundational method for **calculating beta for stocks**, enabling traders to formulate strategies that adequately reflect their investment objectives.

Beta Calculation Methods: A Comprehensive Overview

Calculating beta isn’t limited to one method; diverse techniques are employed for various contexts. This section will delve into practical methods such as **historical beta calculation**, using regression analysis, and leveraged estimators available in commercial software like Excel.

Historical Beta Calculation

The **historical beta calculation** involves gathering historical price data of a stock and the benchmark index (usually the S&P 500). After obtaining the data, determining **beta** is as straightforward as performing a regression analysis. This is accomplished by applying Excel’s regression tools or financial modeling software. Historical betas are particularly useful for investors focusing on long-term performance as they account for past stock market behavior significantly.

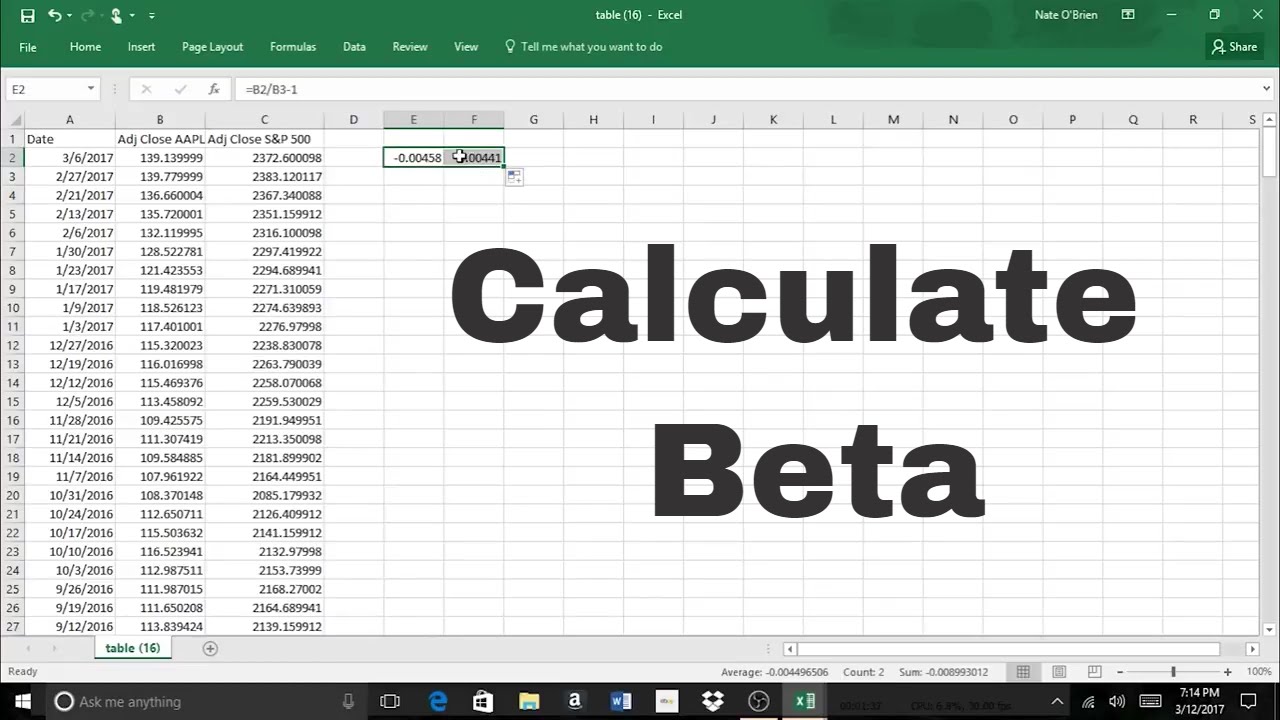

Using Excel for Beta Calculation

To calculate beta using Excel, one can use the **LINEST** function, which provides the slope of the best-fit line for the price data of the stock relative to the market index. Another simple method involves utilizing the Excel formula:

Beta = SLOPE(Stock Returns, Market Returns)

This straightforward methodology allows for rapid calculation of **beta values** from historical returns, making it a practical choice for investors unfamiliar with advanced statistical techniques.

Financial Models Incorporating Beta

In advanced financial analysis, **beta** plays a pivotal role in pricing models, particularly the **Capital Asset Pricing Model (CAPM)**, which describes the relationship between risk and expected return. The equation impacts portfolio diversification strategies by adjusting expected returns based on associated **systematic risk**. Financial analysts often explore adjustments to **beta coefficients** to fit varied investment strategies more effectively.

Interpreting Beta Values for Risk Assessment

The interpretation of beta values involves more than just numerical evaluation; it integrates psychological aspects of trading behaviors. Accurate interpretation can lead to effective **beta trading strategies**, which in turn informs portfolio management.

Adjusting Beta for Risk

Adjusting beta figures is essential when dealing with potential changes in a company’s risk profile. Investors often differentiate between **equity beta calculation** and **asset beta**, challenging traditional thinking and emphasizing the need for an adjusted approach. Factors like **geographical expansion**, or **business model shifts** can warrant recalibration of a stock’s beta for more transparent analysis.

How Beta Affects Portfolio Risk

Understanding how ***beta affects portfolio risk*** is crucial in maintaining a balanced investment approach. A lower beta stock can provide stability during market declines, while a higher beta stock can enhance returns in rising markets. Therefore, integrating various beta values into a portfolio maximizes potential returns and minimizes risk overall.

Real-World Example of Beta in Action

Let’s consider a practical example: Company A has a beta of 1.5, suggesting it is 50% more volatile than the overall market. This implies that in a market increase of 10%, Company A could potentially see a gain of 15%. Conversely, if the market drops by 10%, it may suffer a 15% loss. Such analysis contextualizes **beta in investment decisions**, guiding investors on whether they should incorporate more stable stocks with low beta, or if they prefer higher potential returns with the acknowledgment of increased risk.

Final Thoughts on Beta in 2025 Financial Analysis

As we approach 2025, understanding and utilizing beta effectively will become instrumental for investors. Whether you require detailed market vulnerability analysis or are utilizing **beta for individual stocks**, applying these methodologies enhances your financial analysis. Adopting various calculation methods and interpreting them appropriately can offer competitive advantages and streamline investment strategies for any investor.

FAQ

1. What is the significance of a low beta value?

A low beta value indicates that a stock is less volatile compared to the market, suggesting that it will likely experience smaller fluctuations in price. This makes low beta stocks attractive during market downturns, contributing to a safer investment portfolio.

2. How does measuring beta benefit investors?

Measuring beta aids investors in determining how much risk they are assuming relative to market risk. By understanding this metric, investors can make informed decisions on stock selections that align with their risk tolerance.

3. Can beta be negative, and what does that imply?

Yes, beta can be negative, indicating that a stock moves in the opposite direction of the market. A negative beta suggests that the stock may serve as a hedge against market downturns, being less correlated with overall market volatility.

4. What is the difference between beta and alpha?

Beta measures the relative volatility of a stock compared to the market, while alpha indicates the excess return of an investment relative to the market return, factoring in overall risk. Balancing both concepts is crucial for thorough investment analysis.

5. How do changes in a company affect its beta?

Changes such as acquisitions, changes in management, or shifts in business focus may lead to a recalibration of a stock’s beta. Investors need to continuously evaluate these adjustments to believe the beta reflects the current risks associated with the stock.

6. How do I find the beta of a stock online?

Most financial news websites provide beta values for stocks. Dedicated financial databases and services such as Bloomberg or Yahoo Finance also offer easily accessible beta figures alongside other essential metrics.

7. What are alternatives to beta calculation for risk assessment?

Alternatives include standard deviation for measuring volatility not linked to market movements, the Sharpe ratio for risk-adjusted returns, and Value at Risk (VaR) to assess potential losses in value against risk factors. Different situations warrant different methodologies.

“`